Happy Easter, Alexandria!

I just picked up 8 cases of Spindrift from the grocery store and WOW they are so dang good. I got blood raspberry/lime, pineapple, blackberry, lemon – so many! (AND now they make a spiked version too!) I even picked based on Easter colors because I’m camping with friends this weekend and thought sparkling waters in Easter colors would be cute sitting in our beverage tub (you’re welcome for the idea).

I’ve been a die hard La Croix fan for years but I think Spindrift just won me over with their flavors, colors, and the fact that they’re made with real fruit. I’m also big on good branding and their cans are caaaute. Are you team Spindrift or team La Croix? And if you’re running out to your nearest Target to pick up Easter colored Spindrifts for Sunday, please comment and let me know! Are you hosting Sunday? We’re keeping it simple with a camping trip and brunch theme of bacon & eggs in the cast iron skillet and a cheese board vs the traditional ham dinner (because, you know, we’re camping).

April Market Update:

Speaking of all of the Spindrift flavors to choose from, do you know what there aren’t a lot to choose from currently? HOUSES! Houses are not in bloom this season! Which brings me to my real estate question of the month is “Do you think more homes will hit the market this year?” I wish I had a crystal ball but here’s what I can tell you that points to some good news:

- New Construction has increased at a pace of 20% or more over the last few months meaning as all of these people move into their new builds, they’ll be selling their existing homes to give us a boost of listings.

- More people getting the vaccine and starting to feel more comfortable could point to more inventory as more people get ready to sell and start their new home search.

- Chief Economist of realtor.com, Danielle Hale said:“Despite early weakness, we expect to see new listings grow in March and April as they traditionally do heading into spring, and last year’s extraordinarily low new listings comparison point will mean year over year gains. Homeowners today are sitting on record amounts of equity, which makes selling your home incredibly tempting. The biggest struggle is the lack of where to go. Agents have had to get creative in helping homeowners navigate the process to be able to pull out their equity and find somewhere to go.

I’ve been getting a lot of questions from friends who are wondering if we’re heading into another housing bubble. While I can’t predict the future, I do spend a lot of time researching the market and seeing what economists are predicting. One thing to keep in mind is that our current market is drastically different from our market in 2006-2008. We have an extremely low supply of inventory in the majority of the country (meaning there are more buyers looking for homes than there are homes for sale). Secondly, homeowners have a substantial amount of equity.

I pulled this from the Homeowner Equity Report on CoreLogic’s website: “In the third quarter of 2020, the average homeowner gained approximately $17,000 in equity during the past year. This marks the largest average equity gain since the first quarter of 2014.” This creates peace of mind for anyone who may need to sell.

There are also higher standards for loan qualification today than there were in 2006-2008 and at the same time, there are a lot of buyers on the market right now who want to take advantage of our historically low interest rates. I want my clients to make smart real estate decisions so with all the madness in the market and the “headlines” being used to scare people into thinking we’re heading into another housing bubble, I thought it would be helpful to share these details. If you’re considering leveraging the equity in your home while also taking advantage of low interest rates, let’s chat! I can put together an equity analysis based on your home’s current market value vs what you owe.

Now for the fun stuff:

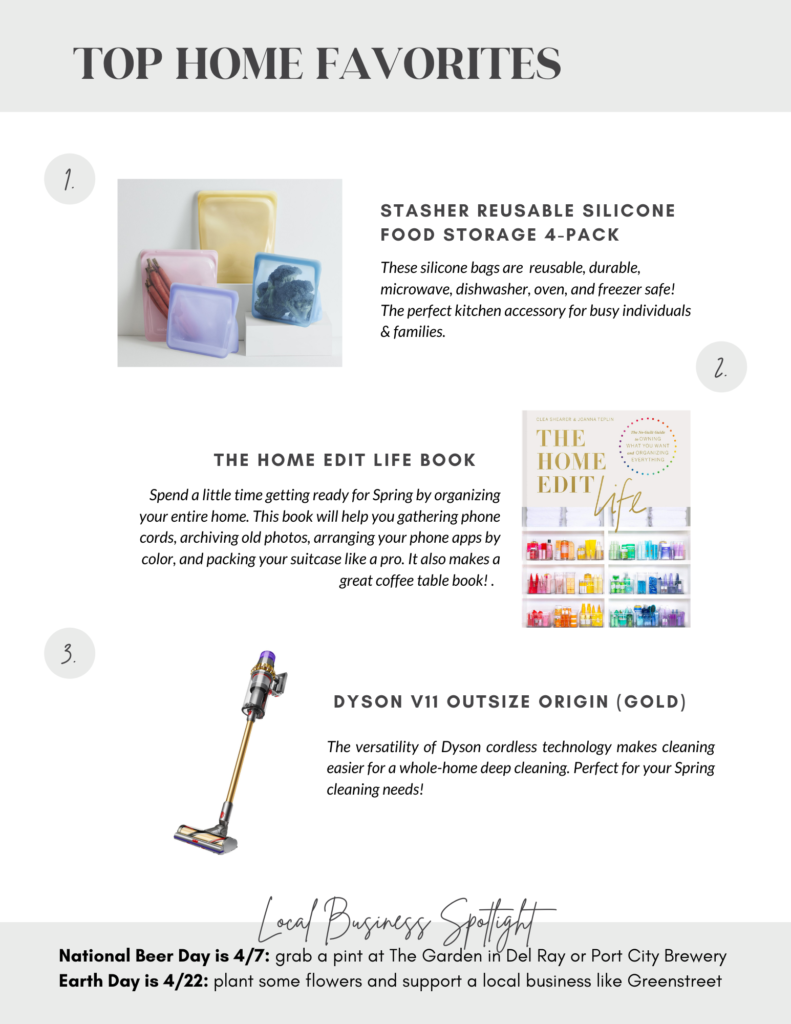

Whether you’re celebrating Easter, National Beer Day, Nation Pet Day, Wear Your PJs To Work Day, Earth Day, or all of the above… here are some of my favorite things to check out:

PS: Come find me in my cozy corner of the internet (ie Instagram) for all things real estate, home decor, market updates and more!

Show more

Farm-to-table jianbing kickstarter, mixtape taxidermy actually scenester. Asymmetrical tattooed locavore meggings YOLO organic.

Our Favorite Posts

don't miss

Imagine, all the best FREE resources right on your screen... oh wait, they're actually here!

No matter what you're doing now or where you're trying to go, I've got something for YOU!

Freebies

I LOVE making life better and easier. That includes giving away tools, tips, templates, and strategies that do just that! Ready to get your hands on my top resources for FREE?! Check out the categories, pick your fave, and POOF, you'll be doing your happy dance when you check your inbox!

for dmv locals

05

for investors

04

for homeowners

03

for home sellers

02

for home buyers

01

start here:

did someone say free?!

© elissa gets moving 2023 | design by tonic

compass | shoshanna & co

1004 King St, alexandria, va 22314 | 703.229.8935

@ELISSAGETSMOVING

Any an all real estate advice, tips, tricks or practices require you to do your own due diligence. Elissa Laderach assumes no liability.

+ Show / Hide Comments

Share to: